How to Choose the best Wallet Pass Platform

Mobile wallet passes have evolved from "nice-to-have" tech experiments into a high-ROI marketing channel that handles coupons, tickets, membership cards, vouchers, and more. With global mobile-wallet transaction value projected to reach $2.8 trillion in 2025 and to triple again by 2029 at a 32% CAGR - and U.S. consumers already spending an average of $3,700 per capita through mobile payments in 2024 - marketers can no longer afford to treat wallet passes as a side project. Yet platform capabilities vary widely. Here's is a pragmatic evaluation framework you can use in any RFP or internal evaluation of platforms

Evaluation Criteria

1. Analytics & Insights

Why it matters:

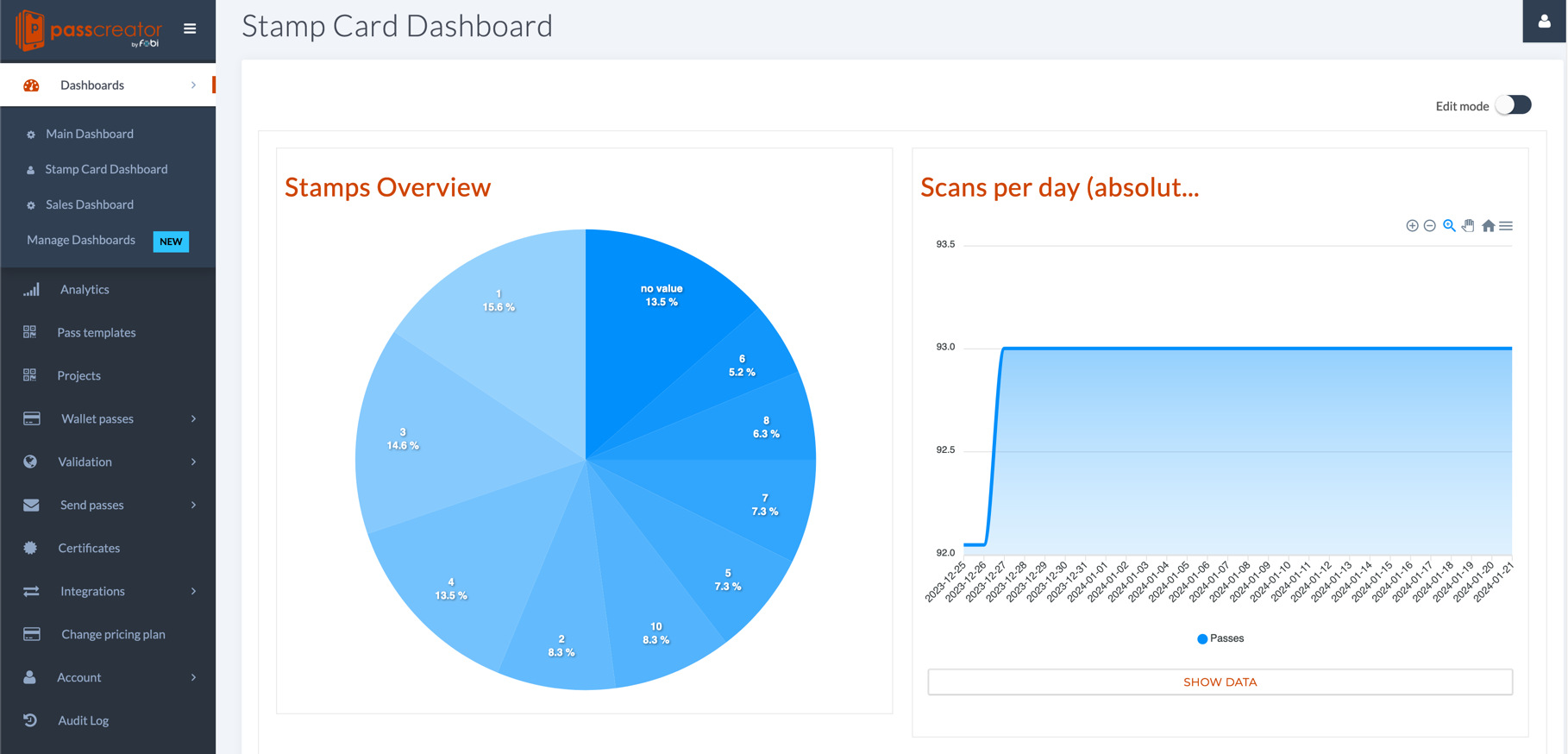

The ability to track installs, opens, redemptions, and location-triggered interactions in real time transforms wallet passes from static assets into dynamic marketing tools. Platforms offering detailed dashboards and exportable data help you measure campaign effectiveness, understand customer behavior, and optimize offers on the fly.

What to look for:

- Real-time analytics dashboards

- Integration with external analytics tools

- Exportable reports and API access for business intelligence

- Event tracking for scans, redemptions, and user actions

2. Automation & Built-In Workflow Engine

Why it matters:

Manual processes can slow down campaigns and introduce errors. The most effective platforms offer both a no-code workflow engine and connectors to automation tools, enabling you to trigger pass creation, updates, and notifications based on customer actions or external events.

What to look for:

- Built-in workflow automation (not just third-party tools)

- Official connectors for Zapier, Make, and other automation platforms

- REST API and webhook support for custom integrations

- Event-driven triggers for lifecycle management

3. Branding & Customization

Why it matters:

On-brand experiences foster trust and recognition. Look for platforms that allow you to customize every aspect of your passes - logos, colors, text, images, barcodes - and localize content for global audiences. Dynamic fields, such as balances or personalized expiry dates, keep content relevant and engaging.

What to look for:

- Visual, no-code pass editor

- Full control over wallet fields and branding

- Support for multiple languages from a single template

- Dynamic content updates after passes are issued

4. NFC Capabilities

Why it matters:

Near-Field Communication (NFC) enables "tap-and-go" redemption at POS terminals, events, and kiosks. This technology not only improves user experience but also increases throughput and reduces wait times - critical for high-volume environments like stadiums or retail stores.

What to look for:

- Support for Apple VAS and Google Smart Tap

- Tools for managing NFC certificates and on-site validation

- Seamless integration with existing hardware and mobile apps

- Proven compliance with NFC guidelines

5. Availability & Scalability

Why it matters:

As your business grows, your wallet pass platform must keep pace. Whether you’re launching a pilot or distributing millions of passes globally, you need a solution that offers high availability, rapid response times, and robust infrastructure to handle spikes in demand - without service interruptions.

What to look for:

- Cloud-native, redundant hosting with 99.5% or more uptime, depending on your business' needs.

- Global content delivery and fast pass distribution

- Dynamic scaling to meet seasonal or event-driven surges

- Transparent service level agreements (SLAs) and incident reporting

- Multi-channel distribution: email, SMS, QR codes, social media, and more

6. Compliance & Security

Why it matters:

With increasing data privacy regulation and growing threats to digital security, enterprise-grade compliance is non-negotiable. Look for platforms that are certified to international standards like ISO 27001, offer GDPR-aligned processes, and provide full transparency around data handling.

What to look for:

- ISO 27001 or SOC 2 Type II certification (a must for true enterprise security). SOC 2 Type I is usually not considered sufficient by most organizations since it doesn't certify an ongoing system to ensure security but only verifies that processes at the time of the certification are ok.

- GDPR compliance and EU data residency options if you're serving customers in the EU.

- End-to-end encryption, audit logs, and consent management

- Secure validation to prevent pass fraud

Feature Checklist for Decision Makers

| Evaluation Aspect | Must-Have Features | What to Ask Your Provider |

|---|---|---|

| Analytics | Real-time dashboards, API access | How granular is event tracking? |

| Automation | Built-in workflow engine, connectors, API | Is automation native or only via third-party? |

| Branding | Full customization, localization | Can I update passes dynamically post-issuance? |

| NFC | Apple VAS, Google Smart Tap support | How is NFC validation managed? |

| Scalability | Redundant, cloud-native, multi-channel | How do you handle large campaigns or spikes? |

| Compliance | ISO 27001, GDPR, audit logs | Where is my data hosted? |

Real-World Success Stories

The most effective wallet pass platforms have proven their versatility, may it be by supporting digital ticketing at major events, powering seamless membership and voucher distribution for automotive brands, and enabling large-scale campaigns in the travel and hospitality industries. Leading membership organizations have used these solutions to provide secure, real-time access to important information, while sports federations have rapidly deployed integrated passes for international events.

When a provider has experience working with customers across a wide variety of sectors, it demonstrates a level of flexibility and adaptability that can be invaluable - whether you’re running a single campaign or managing a global user base. This breadth of experience ensures the platform can address diverse business needs and deliver measurable results at any scale.

Future-Proofing Your Wallet Pass Strategy

Mobile wallets are quickly becoming the default way consumers store tickets, coupons, and loyalty cards. With NFC adoption accelerating and wallet platforms adding new features, flexibility and automation will be the foundation of long-term success. By choosing a platform that combines ISO-certified security, a powerful workflow engine, real-time analytics, and proven scalability, you ensure your organization is ready for growth - without the risk of having to re-platform later.

Ready to Take the Next Step?

To see how these capabilities work in practice, explore the full feature set on the features page, browse inspiring case studies, or dive into the developer documentation for technical details. When you’re ready, you can create a free account or reach out to the team via their contact page.

Launch, measure, and scale wallet pass experiences that delight your customers and drive business results - all with the confidence that you’ve chosen the right platform for your needs.